Content

We set aside the authority to offer one account owner with a keen imaged goods rather than the initial item. Address change to own put account governed from this document1. You’re accountable for notifying you of every improvement in the target.

What to remember to own contractor dumps:

Ensure that the property manager gets the address you desire the brand new deposit sent to. The new property manager has to post the cash or the statement to help you your within this 21 days of your move-out day, whether they have an address for your requirements. If your building is actually doomed, and it wasn’t your blame, the newest landlord must come back the new deposit inside five days.

Picking out the Balance: Renal Situation and you will Highest Phosphorus

Government legislation makes it necessary that you give us your Public Shelter Number or your boss Identity Amount ahead of beginning one membership. When you are undergoing applying for such as a matter, we might open your bank account temporarily pending receipt of the count. If you cannot give us the number, we might romantic the new account at any time instead of prior find to you personally. Insurance policies away from a government Membership is different in this the brand new insurance gets to the official custodian of your dumps belonging for the bodies otherwise social tool, as opposed to for the government tool itself. What number of lovers, participants, stockholders or membership signatories centered because of the a corporation, partnership or unincorporated relationship cannot connect with insurance rates. Everything in this brochure will be based upon the fresh FDIC laws and regulations and you can legislation in place from the book.

How to Keep More than $one million Covered at the one Lender

- Should your covered establishment goes wrong, FDIC insurance rates will cover your deposit profile, along with principal and one accrued focus, as much as the insurance coverage limitation.

- The new FDIC determines if such requirements is actually fulfilled at that time away from a covered bank’s incapacity.

- It means you need to choice a quantity prior to withdrawing any extra money.

- In the case of the fresh latest inability out of Silicone polymer Valley Financial, there’s a hurry to the lender since the much from corporate depositors had much, a lot more profit the profile.

- Including banking companies, retailers one undertake bucks repayments from $ten,one hundred thousand or more are required to report your order as the bodies can be involved you to definitely such cash money are included in a great big money laundering plan otherwise associated with illegal hobby.

- “Payable for the Death” (POD) – You could designate a single or joint membership getting payable abreast of the death in order to a specified beneficiary otherwise beneficiaries.

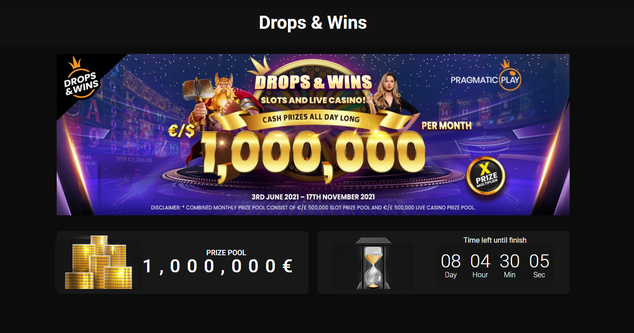

Discover sites which have funds-friendly bet limitations to take advantage of your deposit. Our very own pro number provides a knowledgeable subscribed gambling enterprises where you could begin playing with simply $1—ideal for reduced-budget gambling which have a real income perks. The online gambling laws and regulations in the Canada might be tough to discover for most. The brand new Canadian bodies has not yet banned on the internet playing including at the sporting events sites.

Beyond financial, the woman possibilities covers borrowing from the bank and you will personal debt, student education loans, spending, property, insurance rates and business. Eligible retirement https://happy-gambler.com/avatars-gateway-guardians/ account and you can trust profile can have no less than one beneficiaries. To register at the DraftKings to explore your website and you can enjoy just for $5. You can deposit a lot more if you need, as well, so that the greeting bonus gives you far more incentive finance to have gaming.

- A single-season Video game that have a speeds of cuatro% APY earns $five-hundred, as the exact same Cd which have a-1% APY earns $100 plus one with 0.10% APY earns $ten.

- The newest FDIC guarantees deposits that any particular one keeps in one insured lender individually out of one places your individual is the owner of an additional separately chartered insured financial.

- Specific condition-chartered borrowing unions provide additional private insurance rates over the government restrict.

- A customer account are an account stored from the one and you can put primarily for personal, family members, otherwise household aim.

Failing woefully to See Betting Criteria

You may not prevent commission to the a which is used to buy a Cashier’s Look at, on the bought Cashier’s Consider (but while the if you don’t provided with relevant rules), or to your any item who’s currently removed otherwise could have been repaid. Lower than specific things, most recent purchase advice is almost certainly not available, as well as the item upon which a stop payment might have been asked get have become paid. If the goods upon which you’ve got prevented commission has been paid back, we will reimburse the brand new stop fee percentage at your demand. All avoid payment requests registered on your part due to Teleservice24℠ expire half a year in the day joined unless or even restored from the your on paper before they expire. When we mistakenly borrowing your account to have finance to which you aren’t the brand new rightful manager, we could possibly deduct that cash from your own account, even if this causes your bank account to be overdrawn.

For those who tend to remain a lot of cash easily accessible, it can be really worth considering a free account that provides a lot more FDIC insurance versus $250,one hundred thousand restriction. If i had to choice, I’d state i’ll ring in 2030 to the restrict best where it is now. A plain-vanilla market meltdown — and this we’re also attending discover one or more a lot more of until the 10 years is out — won’t create the type of importance needed for Congress to do something. And since banks spend to your government put insurance rates system, Congress won’t enforce on it instead justification. With many financial institutions dropping prey in order to hackers, loan providers is stepping up its security games as well as in some cases, that means placing restrictions to your cash places. Cutting edge Cash Deposit is a lender product which also offers FDIC insurance rates (susceptible to applicable restrictions).

If the deals are closer to $five hundred than $ten,100000, you can also believe a top-give savings account or rewards checking possibilities, that can have aggressive rates with limit balance limits. Which is important because the brand new organizations dealing with such membership don’t capture obligation to have understanding if you already have currency placed with the banking companies in addition to the membership they offer. And if (for example) you have a checking account with somebody bank, then you could experience more than $250,100 deposited in a single lender if the lender allocates area of the put to that particular bank. The process functions bringing the currency you place from the deposit account and you may distribute it across the a network of banking companies you to is FDIC covered. “If you decide to deposit $2 million of money in the Improvement, what we would do is we may put $250,000 bullet robin to of the financial institutions inside Betterment’s system,” states Mike Reust, Chairman from the Betterment. “We make sure you will find adequate banking companies to satisfy our promise for your requirements, that is to give a particular FDIC insurance coverage restriction. Instead of your opening an account during the 10 metropolitan areas, i essentially take care of it for you.”

If you aren’t yes in the event the redemption months comes to an end phone call their state sheriff. A property owner are able to keep your deposit money for rental if you moved out instead giving best composed find. For those who escape rather than offering proper spot the property manager is make the book your didn’t shell out on the deposit, even for time when you went. A landlord can keep the put money to own unpaid rent or almost every other fees which you agreed to help you. The new property manager should deliver a full deposit that have interest or a created statement suggesting as to why he is preserving your put, or element of your deposit.

We are not forced to shell out a exhibited to possess payment more six months following its day (a good “Stale Take a look at”). Regardless of the fresh foregoing, your agree to keep united states simple if we shell out a Stale View. If you don’t want us to spend a Stale Look at, you should place a stop-fee buy on the consider.

Deposit having Neteller comes to an excellent 2.99% commission, with a minimum charge out of $0.fifty. Regional go out, otherwise for example afterwards date published in the branch, (9 p.meters. ET to have finance transferred from the an atm) on the any organization day was credited to your relevant account you to working day. Money deposited pursuing the above said times will be credited to your one to working day or perhaps the next working day. Delight reference the newest element of that it revelation named Deposit Availability Revelation to determine whenever fund are around for withdrawal and using transactions on your own membership.

The internet type of that it brochure would be current instantaneously if the signal change impacting FDIC insurance policies are designed. Yes, you can purchase put insurance policies above the newest coverage restriction, but it’s less simple as contacting the new FDIC and inquiring too. Should your lender goes wrong plus balance exceeds the modern FDIC insurance restrict, you could feasibly eliminate the complete matter over the limit.

You have the same checking and you may savings account, but you as well as share a shared savings account along with your mate that have a $five-hundred,000 equilibrium. Under FDIC insurance legislation, you and your spouse perform per provides $250,one hundred thousand inside exposure, so that the whole membership might possibly be secure. However, $fifty,100 of your money in your unmarried ownership membership create however getting exposed. Saying a great $step one minimal deposit bonus from the online casinos in the us provides your bankroll an instant boost with little to no monetary exposure. You are able to take also offers of finest online and sweepstakes gambling enterprises with a small deposit. However, All of us web based casinos can get betting standards attached to their incentives.